Home Solar Financing Options & Planning

At Tick Tock Energy, we understand financing can play a big part in going solar, especially when exploring your options for a residential solar power system. Our experts work with you to cut your utility costs and help you find affordable and flexible home solar financing options for your area.

Why Finance Your Home Solar Investment?

Waiting to invest in solar power because of the cost? Delaying your installation could cost you significant savings on electricity and you may miss out on amazing incentives that can help pay for your system. Plus, solar panel prices have dropped considerably over the years and are now more affordable than ever.

Tick Tock Energy works with various lending companies specializing in solar loans, helping you access streamlined financing with a simple application process and competitive rates. Plus, because our lenders offer specialized programs for solar, the qualifying process often goes faster!

1. Design Your Solution

Tick Tock will help you design the perfect solar system for your home, ensuring we accommodate your available space, specific needs, and long-term solar goals.

2. Review Your Quote

Once we know your requirements, our engineers create a tailored plan for your solar power system and provide a detailed quote about the estimated expenses.

3. Apply for Solar Loans

A Tick Tock Energy sales consultant will help you apply for solar power loans in your area to optimize your investment.

4. Install Your New System

With a detailed, data-driven design, we start building, providing materials, installation labor, and electrical work to get your system up and running.

5. Access Lifetime System Support

After installation, Tick Tock supports the lifetime of your system, offering comprehensive operating, maintenance, and monitoring services.

Available Financing Options for Your Home

If you’re a homeowner looking to invest in solar power, we work with various residential solar loan programs to help you optimize your investment. The lenders we work with feature many options to make your system more affordable:

Secured and Unsecured Loans

Our lenders offer secure and unsecured loan options, financing $45,000 to $65,000 depending on the solar lender. Higher amounts are possible for financially strong applicants. Many lenders also offer short-term interest-only options.

Fixed Interest Rates

Solar power loans offer fixed interest rates that are often comparable to local bank rates. Many applicants will qualify for loans from 3.99% to 6.99% depending on length of term and credit strength. The actual rate will be quoted by the lender after you submit your application.

Lower Monthly Payments

With a solar power loan, you can re-amortize the loan once in the first two years to drastically lower your monthly payments. There is also no pre-payment penalties included in solar power loans from Tick Tock Energy lenders.

Best Practices for Residential Solar Financial Planning

Solar loans can help you install a solar power system on your property without the up-front cost. A Tick Tock Energy sales consultant can help you identify available solar financing options in your area to optimize your investment.

Managing Your Cashflow with a Solar Loan

Illinois homeowners must consider a few crucial factors when juggling a solar payment plan, including:

- Monthly Payments: Your monthly payment will depend on the amount financed, your interest rate, and the length of your financing term. The longer the term, the lower the monthly payment.

- Timing: The timing of your federal tax credit and when/if you receive solar renewable energy credits (SREC) will impact your solar payment plan.

- Monthly Electric Bill: While your monthly electric bill savings may not be enough to cover the cost of your solar loan, SRECs or other state rebates can help you achieve positive cashflow annually.

Considering these factors is essential to understand how your financing will play out over the course of your loan. Some months you may have negative cashflow (where the loan payment exceeds your energy savings), but when you receive your SREC payment, you gain a big bump for the year that often puts you “in the black,” or in a positive cashflow position. Adding the federal tax credit also provides an additional boost.

Don’t Let Your Electric Bill Own You

Solar is a long-lasting asset that generates valuable electricity. Over 20 years, think about all the money you may spend on high electricity bills. Even with a solar loan, you’ll come out ahead! Keep your hard-earned cash and capture great incentives to make your solar power system a sound investment.

Flexible Residential Solar Loan Options

Tick Tock Energy works with Sungage Financial, one of the leading residential solar loan providers in the US. Financing residential solar makes solar affordable with low monthly cost instead of an upfront investment. In Illinois, lucrative solar incentives that are received months after the project is complete can then be used to pay down or pay off the loan within two years. Or, you can pay the loan partially down with incentives and elect to keep a low monthly loan payment longer term. In most cases, your electric bill savings will be larger than your solar loan payment. This creates a new positive cashflow stream for your household by going solar!

Ready to Start?

Request a free quote today

Tick Tock Energy is ready to help you invest in a clean solar energy system on your property, capture lucrative solar incentives, reduce long-term electricity costs, and and enhance the value of your property. To discuss your power needs with one of our solar consultants, request an initial consultation and quote today.

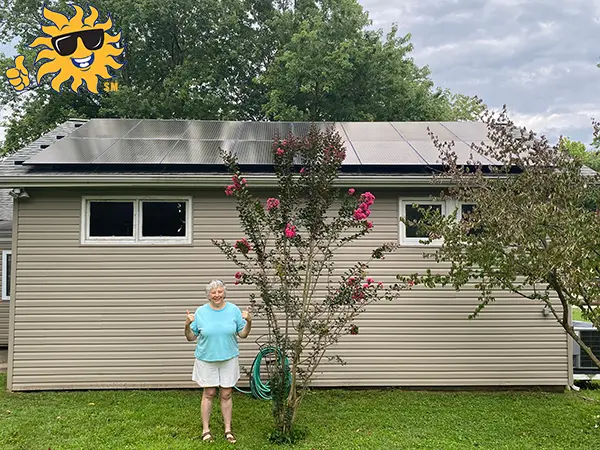

Tick Tock has helped countless homeowners across the Midwest enhance the value of their property and reduce their utility costs with solar power systems. Explore our recent installations below.

Our Customers Are

Thumbs up for solar