New Bill Cuts Federal Tax Credits: Take Action Today!

The One Big Beautiful Bill Act (OBBB) was signed into law on July 4th, 2025, signaling big changes in federal tax credits for solar energy systems, but there is still time to act.

The Clock is Ticking on Solar Tax Credits

The OBB contains hundreds of provisions, many of which focus on taxes. The new bill changes the timelines on the phaseout of solar and energy storage clean energy tax credits. Residential solar incentives are now expired as of 12/31/25 unless a qualified 3rd-party ownership model applies. Commercial business, farms and non-profits are still are eligible but under new rules and conditions. If any project enters into contract after 7/4/26 the deadline to finish installed projects is end of 2027. Now is the time to act before it’s too late.

New Requirements for Qualifying For Solar Tax Credits

The One Big Beautiful Bill Act has changed how business and homeowners qualify for solar investment tax credits. Solar tax credits help offset tax liability and help defray the cost of installing solar. The summaries below highlight some of the key changes by segment.

Commercial

The 30% commercial tax credit (48E) is being phased out early, and to take advantage of this benefit before it runs out, there are a few requirements:

- Commercial solar projects must begin construction by July 4th, 2026 to remain eligible for the full 30% federal tax credit.

- Projects that begin construction after July 4th, 2026 must be placed in service before December 31st, 2027 to qualify for the tax credit.

- Projects that begin construction on or after January 1st, 2026 will be subject to limited federal tax credit eligibility if more than 60% of the materials used are sourced from a Prohibited Foreign Entity.

- Bonus tax credits from the IRA legislation remain unchanged, offering a 10% bonus for Energy Community and Domestic Content.

Residential Homes

The 30% residential tax credit (25D) expired at the end of 2025. However, qualifying 3rd-party leasing structures may still qualify and Tick Tock Energy can assist. With high electricity rates it still makes sense to lower your electric bill. The Illinois SREC incentive and other rebates may still apply.

Non-Profit Entities

Non-profits will face the same deadlines as commercial businesses as the commercial tax credit (48E) is being phased out early. While non-profits are still eligible from IRA law to take this incentive as direct pay, there has never been a better time to invest in solar power.

Like commercial businesses, non-profits that begin solar power projects before July 4th, 2026 remain eligible for the full 30% tax credit, and projects that start construction after this date must be placed in service before December 31st, 2027 to qualify. Non-profits are also subject to limited eligibility if more than 60% of materials are sourced from a Prohibited Foreign Entity and can access bonus tax credits for Energy Community and Domestic Content.

Other Solar Power Incentive Updates to Consider

The federal tax credits are not the only solar incentives being impacted. There are a few other items to consider beyond the OBBB (HR1) tax changes.

Illinois Shines and SRECs

The Illinois Shines program is not impacted by the OBBB tax changes. Illinois is one of few states that pays you to generate clean energy from solar. Solar renewable energy credits (SRECs) can help solar system owners recoup their investment while diversifying electrical power systems in Illinois.

USDA REAP Grant

While not directly impacted by the OBBB, this program has experienced some program updates as well. The USDA REAP Grant is accepting applications but some rules and award dates may update at any time.

Utility Approvals

Electric utility lines are becoming more congested by the day, and delays could result in required line upgrades or system downsizing for approval to interconnect your solar project. Tick Tock Energy has ample experience working with utility companies to ensure our clients have access to cost-saving, sustainable solar power.

Supply Chain

With the FEOC requirements starting on January 1st, 2026, the supply chain woes could easily return as solar contractors adjust and try to source as much American-made materials as possible. Contact Tick Tock Energy to get started on your solar project before tax credits and supply chain changes impact availability.

Access Custom Solar Power Financing Options at Tick Tock Energy

While federal tax credits may be changing, Tick Tock offers flexible solar loan or lease financing options to make your new system affordable. Our customizable payment plans can help you implement a solar power system with ease while taking advantage of available incentives and tax credits. Contact our experts today to find a financing option that works best for your needs.

Explore Our Solar Solutions

Whether in a commercial, agricultural, or residential setting, Tick Tock Energy’s solar power systems offer reliable energy production while slashing electricity costs.

Ready to Start?

Request a free quote today

Tick Tock Energy is ready to help you invest in a clean solar energy system on your property, capture lucrative solar incentives, reduce long-term electricity costs, and and enhance the value of your property. To discuss your power needs with one of our solar consultants, request an initial consultation and quote today.

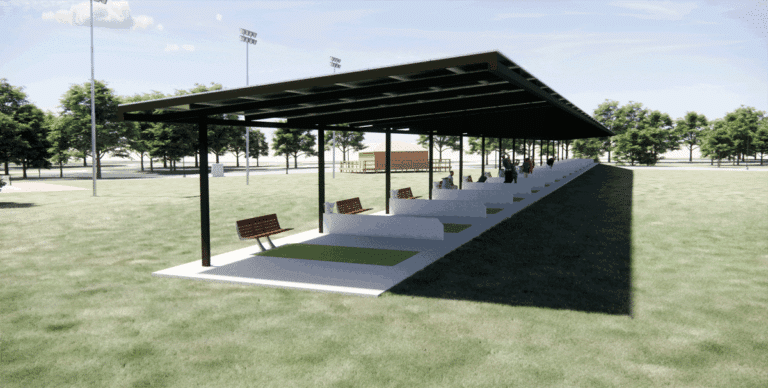

Tick Tock has helped businesses across Illinois and in Indiana, and Missouri to enhance the value of their property and reduce their electricity costs with solar power systems. Explore our recent installations below.

Tick Tock Customers Are

Thumbs Up for Solar! ®

Commercial Solar Installation Testimonial for Tick Tock Energy / VFW Hall Lawrenceville, IL