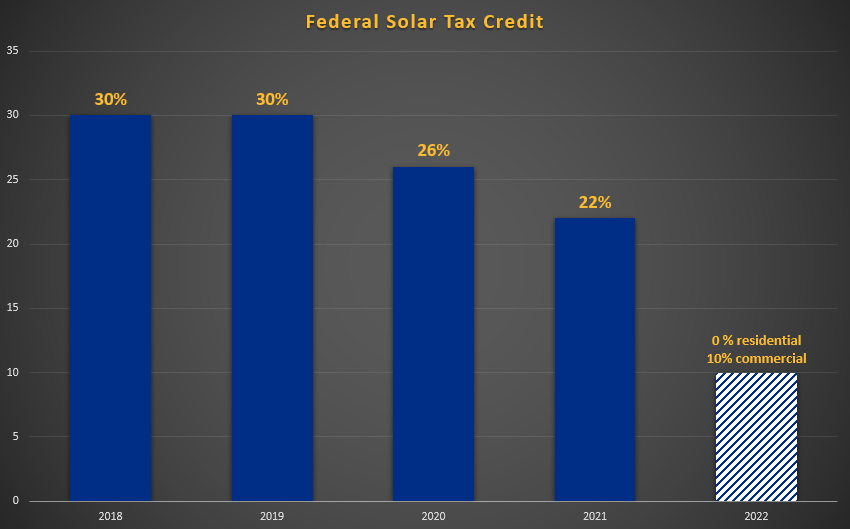

Many solar homeowners and businesses have benefited from generous federal solar tax credits. But like all good things, these tax credits will end and start to phase-out after 2019

What Are Federal Solar Tax Credits?

Since 2005, the federal government has allowed solar homeowners and businesses to claim a 30 percent tax credit against the cost of installing solar on their property. This tax credit, also known as the investment tax credit (ITC), has no value caps and can be used to reduce tax liability. The tax credit program was set to expire at the end of 2007, but a series of extensions pushed that date back until the end of 2021.

When Do The Tax Credits End?

Beginning in 2020, the federal solar tax credit will decrease to 26 percent in 2020, 22 percent in 2021, then 0 percent for residential and 10 percent for commercial solar installations in 2022 (see graph above). The 10 percent commercial tax incentive will remain permanent.

Will The Tax Credit Be Extended?

Though the federal solar tax credit has been extended several times, there is great uncertainty if that will happen again. With the costs of installing solar decreasing rapidly and renewable energy now becoming competitive with traditional forms of energy, Congress might not see the need to extend its support of the solar industry.

What Does This Mean for You?

Have you been thinking of capturing the benefits of solar? Have you been holding off on the decision? Ultimately, the time to install solar has never been better, with material costs the lowest ever and tax credits the highest they have ever been. By acting now, you can lock in the maximum benefits of federal solar tax credits and begin slashing your energy bills.

Are You Eligible?

If you are a homeowner or a business and install a solar system on your property, you are eligible for the tax credit. If you don’t have enough tax liability to claim the entire credit in one year, you can roll over the remaining credit to the following year. You might be able to continue to roll unused tax credit forward but this is a matter that should be carefully discussed and approved by your tax professional. As with all tax related matters, you should consult with a CPA or qualified tax adviser to see if you can utilize a tax credit. The ITC is not a rebate or automatic deduction and only offsets tax liability so do your homework.

How to File for the Federal Tax Credit (Residential Homeowners)

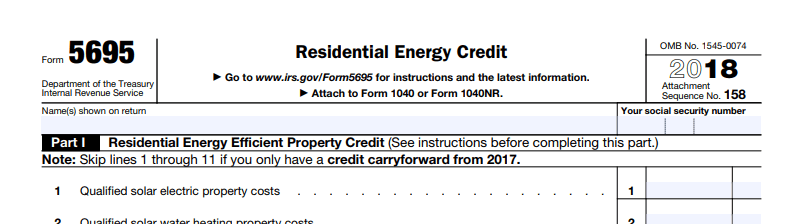

For the 2019 tax year, residential solar customers who wish to utilize the federal solar tax credit will need to use tax Form 5695-Residential Energy Credit.

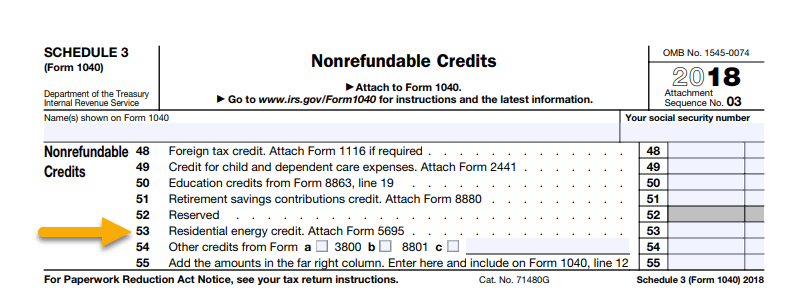

The results of Form 5695 will flow into the line 53 of Schedule 3.

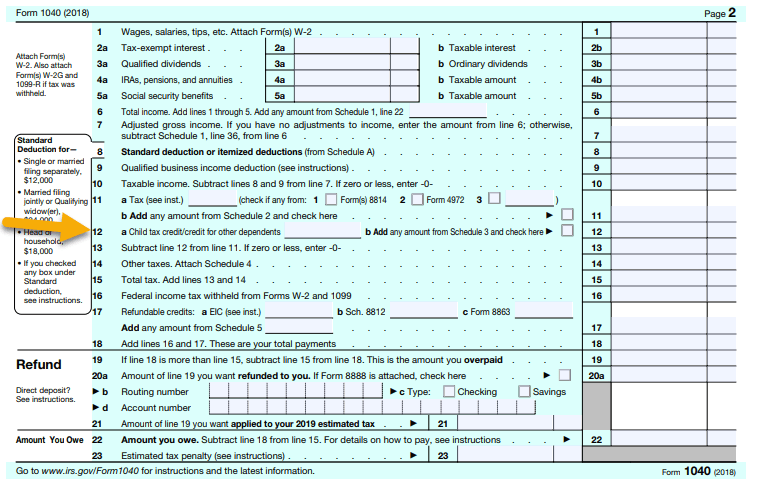

The outcome of the Schedule 13 then flows into page 2, line 12 of tax Form 1040, where it is finally determined how much the tax credit reduces your tax liability. The federal solar tax credit is a dollar-for-dollar reduction in your tax liability so has more impact than a regular deduction.

It’s important to note that if line 13 of Form 1040 is 0, your tax credits will carry forward to next year. However, it might not be advisable to continue carrying over a tax credit into ongoing years. Ongoing carryover tax credits is something you should discuss with your tax advisor.

How Can You Capture Solar Benefits Before It’s Too Late?

To learn more about how you can lock in the benefits of solar energy and federal solar tax credits, contact Tick Tock Energy today! We can answer all your questions and get you on the quick path to significant savings.

*Note: Information within this article should not substitute the advice and counsel of your CPA or tax advisor.